Telcos selling digital signage is a promising SaaS trend that shows no sign (pun intended) of going away soon.

Conversely, more and more telecom operators are putting together innovative white-labeled digital signage offerings for their B2B customers. Which is great news for digital signage providers (including ourselves) and a great opportunity for resellers. We explored the main reasons for this in last week’s blog. This time, let’s look at why telcos selling digital signage is a match made in heaven in terms of a SaaS value proposition for businesses, and a revenue generator for the telco’s industry.

If you want to join our reseller program, read more about it here.

Telcos selling digital signage: a goldmine business?

So what is it with selling B2B digital signage and telcos? Ernst and Young sum up the concept pretty accurately with this statement:

“With only a small outlay of manpower and money, opening or expanding a digital signage offering could lead telecoms businesses into markets that give many times the revenue of the digital signage market itself.”

EY points out that there is so much potential for telcos selling digital signage that opportunities are already being missed. Because while many telecoms companies are already operating in the DS market, they are only offering it as an add-on to existing packages. For example, selling digital screens to small businesses, such as cafes, bars and restaurants or offices, on top of basic communications services.

This is just the tip of the iceberg of what DS could do for telcos. It represents a small market for big firms, with low margins and low potential for growth. As EY’s experts rightly say, they are missing out on the true potential of digital signage. Globally, in 2021 the DS market was valued at $16.3b, and is expected to be worth US$27.8b by the end of 2026.

A small leap in sophistication

The good news is that telcos are seeing the light. Increasingly, they are coming up with more sophisticated versions of DS offerings. On top of the basic physical signage, telcos selling digital signage are starting to also provide targeted on-site “proximity digital signage” (i.e., promotions and advertising) direct to their customers’ mobile phones. And this is where the revenues will be unlocked. Everywhere. For virtually any business customer in any industry.

What digital telcos can leverage to maximize DS?

So, what is it that makes telcos specifically an attractive “spouse”, as it were, for DS as a SaaS revenue generator? I would start with the ease with which telcos can repackage and resell pioneering yet easy-to-use DS services, such as Yodeck, packed with innovative features. But of course it doesn’t stop there. Below is a breakdown of the key advantages telcos have, which make them ideal DS resellers:

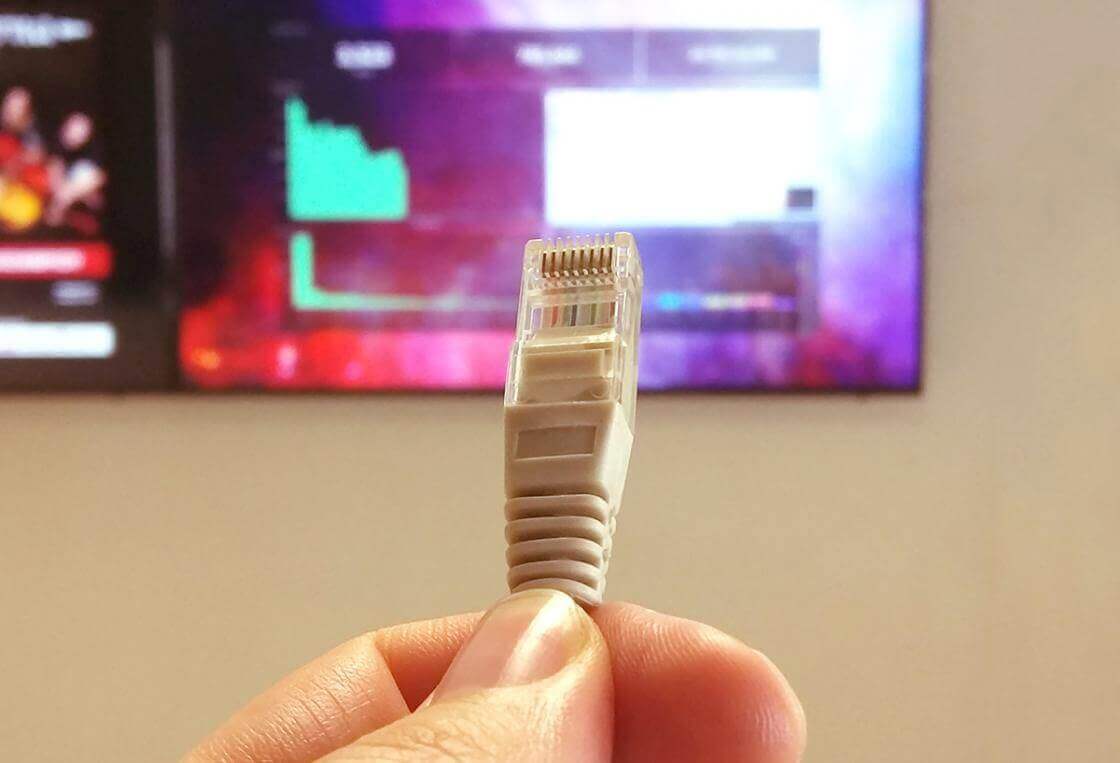

Internet access or data-based products

- Connectivity for all types of devices.

- Bundles of internet access services with DS can be put together in various value proposition scenarios.

- Mobile: incorporate 4G/5G Access into the DS devices.

Brick-and-mortar stores

- Showcase physical installations of DS solutions for actual demo purposes (try before you buy).

- Customers can buy equipment and service on the spot, and set it up themselves.

Sales teams

- DS is growing in the low end of the market, so many B2B customers may even be unaware they need it. Thus a telco’s sales team can refocus their efforts and really up-sell.

- DS is a very simple solution to demonstrate, so even existing sales staff with basic training can deliver live demos on customer premises.

On-site support

- Providing a complete DS solution means also having on the ground support for any setup, maintenance and technical issues. Telcos already have such experienced staff.

- There is minimal training/expertise required to run majority of DS solutions. So the same field engineer profile is a good fit.

Licensed content

- Telcos can up-sell video content already licensed (like Satellite/IP TV, or online streaming) to the DS customer, and vice-versa — augment content with customer-managed content.

Equipment suppliers & integrators

- Can leverage existing hardware partnerships to procure hardware, especially if hardware is not a proprietary platform.

Tried and tested digital signage business model in telco sector

- Equipment + software + support services is a familiar business model for telcos.

- Subsidizing low cost hardware is already in their business model.

- Like most telecoms services DS is also a long-term service – contract can be for two years – with expected contract lifetime of four years.

Is it true love?

It’s difficult to say if it really is true love just yet, but the relationship is certainly blossoming into a match made in heaven. The point is where telcos go from here. Telcos selling true digital signage are in an ideal position to exploit their ability to send advertising to customers at any time and in any place. This means simply that they can expand easily and exponentially while they sell digital signage and digital signage advertising space. Instead of focusing on DS solutions at points of sale for example, they can and are moving to send targeted advertising all over a city.

As EY points out, “In short, by taking DS seriously, and taking on board the lessons it has to offer, telecoms businesses would be able to expand potential revenue significantly.”